VPBank NEOBiz - A Centralized Digital Financial Platform Launched to Offer Businesses Diverse Financial Services

2025

15/07/2025

Understanding the concerns of corporate clients in the current context, amidst new regulations, policies, and the numerous challenges of the integration era, how to better control cash flow, minimize risks, and optimize capital utilization?.... VPBank has designed and centralized financial services and solutions to support businesses, consolidating them into one “station,” a single website address: https://neobizplus.vpbank.com.vn/doanh-ngiep. VPBank NEOBiz becomes the optimal touchpoint where all experiences and service usage processes for corporate clients are enhanced and streamlined.

VPBank NEOBiz – A Multi-Service Platform

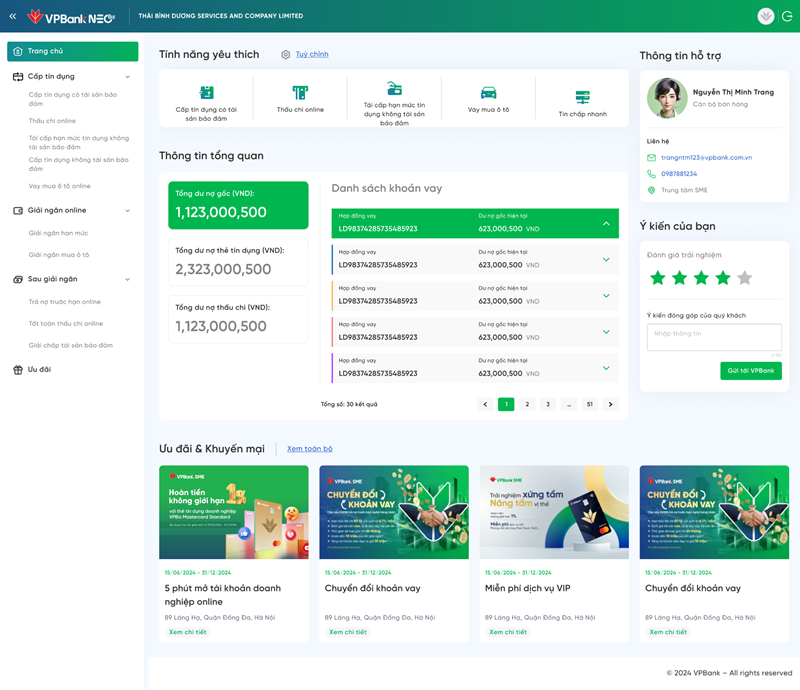

With the newly “structured” platform, VPBank NEOBiz can instantly support numerous financial services integrated centrally on an intuitive, easy-to-use interface. By accessing VPBank NEOBiz, corporate clients can:

- Register and monitor loans

- Disburse loans

- Post-loan services support: early loan repayment, overdraft settlement, asset release

- Manage credit limits and real-time cash flow

- Manage corporate credit cards

- Access preferential programs and promotions

- Connect and receive support from assigned officers

- Submit feedback and evaluate services directly on the platform

Integrating services on a single platform not only saves businesses time but also simplifies the entire financial transaction journey.

VPBank NEOBiz – Flexible Online Credit Granting and Disbursement

One of the key features of VPBank NEOBiz is enabling clients to be proactive in credit transactions. Businesses can independently submit requests for new or renewed credit limits, both secured and unsecured, corporate overdrafts, as well as actively disburse funds for needs such as car loans or utilizing pre-approved limits.

Furthermore, VPBank NEOBiz also supports post-disbursement services: early loan repayment, overdraft settlement, or collateral release. All of these can be performed directly on this platform without needing to visit a bank branch, maximizing time and resource savings for businesses.

Secure and Safe – A Solid Foundation for Digital Transactions

Security and safety are always VPBank's top priorities when developing VPBank NEOBiz. All client transactions conducted via VPBank NEOBiz are always authenticated with an OTP code.

Unusual login alerts are activated to mitigate the risk of unauthorized access to VPBank NEOBiz. The system will automatically lock the account if the user enters the wrong password more than 3 times, ensuring that all access is performed by the "rightful owner."

While ensuring security and safety, VPBank NEOBiz also provides a convenient experience, supporting account unlocking when users successfully complete the secure authentication steps.

Modern Interface - Personalized Experience.

Emphasizing usability and user-friendliness, the VPBank NEOBiz interface is professionally and logically designed, providing clients with an overview of all products and services VPBank offers to businesses.

The new VPBank NEOBiz platform interface centralizes numerous services and features

VPBank NEOBiz allows users to customize favorite features to display directly on the main screen. Additionally, the information of the dedicated sales officer is clearly displayed with full name, phone number, and email, making it easy for businesses to contact them for support. Beyond providing important announcements and attractive offers, VPBank NEOBiz also serves as a channel for receiving and listening to direct feedback and evaluations from clients with complete objectivity and willingness to improve, to continue enhancing services in the future.

Currently, the VPBank NEOBiz platform is ready to serve all existing corporate clients via the website platform. VPBank continues to develop the system to further optimize user experience, expand to an application-based platform, and extend touchpoints to the business community on their journey of comprehensive digital development and transformation. VPBank will promptly notify valued clients for easy monitoring and use.

A multi-utility touchpoint - VPBank NEOBiz empowers businesses to proactively manage financial services to accelerate on the path to prosperity.

For more detailed information, please contact Hotline 1900 234568, or email: chamsocdoanhnghiep@vpbank.com.vn